The News You Need To Know | March 2017

Some timeless wisdom.

Provided by Loring Ward

With many stock market indices at all-time highs, Washington awash in political turmoil and unsettling news around the globe, many investors may be unsure what to do next.

And we believe that is a good thing.

As investors, we’d love to be able to invest in a “sure thing.” We’d much prefer not having to worry about our portfolio and whether we’ll have enough for a comfortable retirement.

However, one of the most important factors that may work in our favor over the long term is the unpredictability of markets. The risks created by this uncertainty can also mean potential rewards, just as great certainty usually entails minimal rewards.

For example, the closest thing we have to a safe investment is U.S. Treasury Bills, which are backed by the U.S. Government. Right now, the 30-year T-Bill is yielding a little more than 3%, just above America’s long-term historical rate of inflation. For most investors, that kind of return won’t be enough to provide for 30-plus years in retirement. We believe that many of us will have to embrace uncertainty, take on some degree of risk and invest in the stock market.

One of the paradoxes of investing is that if a market or sector or even specific stock offered high guaranteed returns, everyone would want to own it, and those high returns may then drop and drop and drop until they approached the level of T-Bills. In general, the riskier an asset, the greater its potential returns. After all, few of us would want to invest in a risky asset that offered low returns.

Still, numerous pundits claim that they have insights that can pierce the veil of uncertainty and provide us with clarity.

The media is full of stories about what the Trump administration will or will not do — and what this means for investors. These can be general: “How a Trump Presidency Will Affect 15 Industries” or “How to Invest Under a Trump Presidency;” and sometimes as specific as “7 Top Stocks to Buy with Trump as President.”1

Many of these headlines appear in the same publications that predicted economic catastrophe if Trump were elected and we believe will probably be just as wrong.

When President Obama was sworn into office in 2009, the Great Recession was getting worse, with the S&P 500 Index at 805 points. You might have considered it a bad time to invest in anything. Yet eight years later, the S&P 500 was at 2,274 points and had returned a cumulative 235%, or 16.4% annualized.2

Perhaps in 2009 you wanted to invest in stocks in specific sectors. It seemed clear from Obama’s speeches and policy proposals that defense spending would not be a priority, firearms might be restricted, there’d be increased spending on renewable energy and that banks and financial firms were going to be subject to stronger regulations.

So what if you’d invested in what appeared to be “certainties” or at least fairly reasonable assumptions?

The solar industry did not see the gains many would have expected. In fact, the MAC Global Solar Energy Index saw a 79% decline during Obama’s two terms.3

Meanwhile the defense industry, as measured by the S&P’s Aerospace & Defense Select

Industry Index (SPSIAD), enjoyed a healthy cumulative return of over 274% during the next eight years, beating the S&P 500 Index.4

Even the S&P 500 Financials Index (SPF) returned a relatively robust cumulative 165.32%.5

As for guns, Smith & Wesson (SWHC) and Sturm Ruger (RGR), the only two publicly traded firearms stocks, grew 1,050% and 832% during Obama’s two terms.6

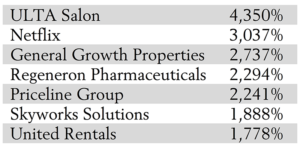

It is eye opening to look at the top seven performing stocks in the S&P 500 Index over the same period.7

None of these top seven stocks have much in common with each other — pharmaceuticals, real estate, computer chips, equipment rentals, on-demand movies and discount travel — and the top performing stock, ULTA Salon, is not some technological innovator, but a chain of salons/beauty stores best known for their discounts.

None of these results were predictable in advance. And even if you knew with absolute certainty that a specific policy or law would be enacted during the Trump administration, the impact on a particular stock price likely would be equally uncertain.

So what is an investor to do? Ignore the pundits, diversify broadly and globally, and embrace uncertainty and the potential it may offer to reward you over the long term for the risks it entails.

Citations:

1-The Washington Post, Nov. 12, 2016; Kiplinger, Nov. 11, 2016; The Motley Fool, Nov. 18, 2016

2-Forbes, “Inside The Obama Stock Market’s 235% Return,” January 17, 2017

3-MAC Global Solar Energy Index TR USD, Morningstar Direct, February 2017

4-S&P 500 Ind/Aerospace&Defence TR USD, Morningstar Direct, February 2017

5-S&P 500 Sec/Financials TR USD, Morningstar Direct, February 2017

6-Investor’s Business Daily, “Can Trump Revive Reagan’s Stock-Market Magic?” December 27, 2016

7-The Motley Fool, “The 10 Best Stocks During the Obama Administration,” January 19, 2017

Diversification neither assures a profit nor guarantees against loss in a declining market. Investment advisory services provided by LWI Financial Inc. (“Loring Ward”). Securities transactions offered through its affiliate, Loring Ward Securities Inc., member FINRA/SIPC. R 17-051 (2/19)