Quarterly Economic Update

A review of 3Q 2015

THE QUARTER IN BRIEF

The third quarter of 2015 is now history – and what a trying quarter it was. In looking back at Q3, we see not only a rough stretch for stocks and commodities but also a period in which the financial narrative for the year changed. At the start of July, investors focused on whether or not the Federal Reserve would raise interest rates in September. By the end of the quarter, the evident economic slowdown in China had become the year’s defining story. Key U.S. indicators waned as the quarter progressed, though the housing sector maintained its impressive sales pace. The stock market pulled back – the S&P 500 lost 6.94% in the quarter, which left it negative year-to-date.1

DOMESTIC ECONOMIC HEALTH

As the quarter unfolded, the deceleration in overseas manufacturing began to affect America. For evidence, one needed only to look to hiring totals, hard goods orders, and the ISM purchasing manager index tracking the factory sector.

Even with its anecdotal basis, ISM’s manufacturing index is a hugely important indicator – and it was troubling to see it decline from a July reading of 52.7 to a September mark of 50.2, near the contraction level. (ISM’s non-manufacturing PMI went from 60.3 to 56.9 in the same span.) By August, headline durable goods orders were down 24.1% year-over year.2,3,4

In September, the economy added a disappointing 142,000 new jobs – and the Labor Department revised July and August hiring downward to respective totals of 223,000 and 136,000. Annualized wage growth – which should be between 3-4% – remained low at 2.2%. The good news? In the ninth month of the year, headline unemployment was down to 5.1% while the U-6 “underemployment” rate dipped to 10.0%.5

Inflation – at least as measured by the Consumer Price Index – remained a minor economic factor. By August, the CPI was up just 0.2% in the past 12 months, with the core CPI up just 1.8%. The headline CPI retreated 0.1% in August, its first pullback since January. As for the Producer Price Index, it was flat in August after a 0.2% rise in July; by August, annualized wholesale inflation was at -0.8%, negative for the seventh month in a row due to reduced energy costs.6,7

Consumer confidence and personal spending held up reasonably well as economic warning signals came in from abroad. The Conference Board’s consumer confidence index reached a September mark of 103.0, rising from 101.5 in August. While the University of Michigan’s household sentiment index declined during each month of the third quarter, its final September reading of 87.2 represented a year-over-year advance of 2.6 points. Consumer spending was up 0.4% in both July and August; consumer incomes rose 0.5% in July and 0.3% in August. Retail purchases were up 0.7% in July and another 0.2% for August.8,9

As the quarter went on, the chances of the Federal Reserve raising interest rates seemed less likely. Indeed, the Fed made no move in September – but a dot-plot forecast it published projected the federal funds rate at 0.40% by the end of 2015. The poor September jobs report could alter that projection, as could the ongoing “global economic and financial developments” that the central bank referenced as cause to leave rates alone.10

GLOBAL ECONOMIC HEALTH

Greece may have seized the headlines in Q2, but in Q3 the big story was China. Its stock market exhibited extreme volatility and its economic indicators unsettled investors here and abroad. By July, the warnings were evident: Chinese exports had shrunk 8.3% in a year, imports had fallen for nine consecutive months and the retail sales pace had reached a 15-year low.11,12

During Q3, the Shanghai Composite dropped more than 25%. China surprised investors by devaluing the yuan in August; it responded to the correction by putting severe controls on its stock market. China’s official manufacturing PMI showed sector contraction for a second straight month in September, ticking up to 49.8 from 49.7. The Markit/Caixin private-sector factory PMI for China hit a 5½-year low of 47.2 in September. Since as much as half the worldwide demand for coal, copper, and iron stems from China, this was troubling news indeed.13,14

Economists questioned if China’s official GDP and manufacturing PMI readings were being vastly overstated. Oxford Economics estimates China’s 2015 GDP will be between 3-4%, and leading Swedish economist Mauro Gozzo projects 3% growth – far removed from the 7% expansion forecast by Chinese government officials.15

The Markit (official) manufacturing PMI for the eurozone was a comparatively healthy 52.0 in September, down from 52.3 in August. Deflation had returned: the eurozone CPI retreated 0.1% year-over-year through September. The region’s unemployment rate remained at 11.0% last month.14,16

WORLD MARKETS

Worldwide, only two stock indices had a positive quarter – Ireland’s ISEQ rose 0.04% and Sri Lanka’s Colombo Stock Exchange 0.43%. As for the losses, they were most severe in the emerging markets: the Shanghai Composite sank 28.63%, the Hang Seng 20.59%, the Nikkei 225 14.07%, the Asia Dow 17.68%, the Jakarta Composite 13.98%, the RTS 15.98%, the Bovespa 15.11%, and the Merval 15.80%. The MSCI Emerging Markets Index retreated 18.53%.1,17

Other benchmarks lost comparatively less: the CAC-40 retreated 6.99%, the DAX 11.74%, the Kospi 5.37%, the Sensex 5.85%, the Dow Jones Americas 8.42%, the Europe Dow 10.69%, the Global Dow 10.65%, the FTSE 100 7.04%, the STOXX 600 8.80%, and the MSCI World Index 8.86%.1,17

COMMODITIES MARKETS

Last quarter, the Thomson Reuters/Jefferies CRB Index suffered a loss of 14.71%. The other notable commodity sector benchmark, the S&P GSCI index, retreated 19.3% (its poorest third quarter in 45 years).18,19

Looking at the S&P GSCI quarterly scorecard, only lean hogs posted a three-month advance, gaining 13.4%; the other 23 commodities all retreated. There were some major Q3 descents among ag and energy futures: crude oil lost 26.9%, unleaded gasoline 21.0%, heating oil 20.9%, and wheat 21.2%. Crude oil ended the quarter at $45.09 a barrel on the NYMEX.19,20

Precious and base metals also declined notably in Q3. Gold lost 4.8%, settling at a COMEX price of $1,115.20 an ounce on the quarter’s final day. Silver fell 6.8% in Q3, platinum 15.8%, palladium 3.2%, zinc 15.9%, copper 10.2%, and aluminum 7.9%.19,21

Did the U.S. Dollar Index manage a third-quarter advance? Yes, it did. It settled at 96.35 on September 30, up 0.90% in three months.22

REAL ESTATE

By August, new and existing homes were being bought up at a pace nicely exceeding year-ago levels. According to the National Association of Realtors, resales were up 6.2% annually in August, even after August turned out to be the second-weakest month for existing home sales in the past four-and-a-half years; 32% of buyers were first-timers. A Census Bureau report showed new home buying surging 21.6% in the 12 months ending in August.23

NAR’s pending home sales index softened by 1.4% in August, but even with that retreat, it remained 6.1% higher than a year ago at a healthy 109.4. The overall S&P/Case-Shiller home price index for July showed a 5.0% advance across the past 12 months, ticking north from 4.9% in June.8,23

Housing starts and building permits also showed significant annual gains according to the Census Bureau. Groundbreaking had increased 16.6% in the 12 months ending in August (14.9% for single-family projects). The number of permits issued in August surpassed the August 2014 number by 12.5% (8.7% for single-family construction).24

Did home loans become more expensive in Q3? For the most part, no. A quick check of the June 25 and September 24 Freddie Mac Primary Mortgage Market Surveys shows average interest rates increasing only on the 1-year ARM, from 2.50% to 2.53%. The 30-year fixed grew cheaper, with the average interest rate sinking from 4.02% to 3.86%. The story was similar for the 15-year FRM and the 5/1-year ARM; average interest rates on the former declined from 3.21% to 3.08%, while average interest rates on the latter dipped from 2.98% to 2.91%.25

LOOKING BACK…LOOKING FORWARD

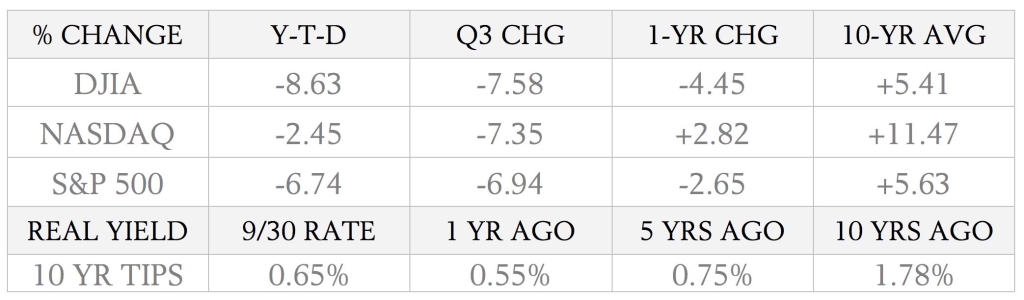

Were there any bright spots on Wall Street during a dismal quarter? Yes. Beneath the big three, a few indices did post some nice three-month advances. The Dow Jones Internet index gained 7.07% in Q3, and the Dow Jones Utilities Average rose 4.82%. The Nasdaq Insurance index ticked up 0.73% for Q3. This paled in comparison to the 34.39% Q3 rise of the CBOE VIX. As the table below shows, Q3 performances for the marquee indices left much to be desired. Their quarter-end settlements were as follows: DJIA, 16,284.70; S&P 500, 1,920.03; NASDAQ, 4,620.16. The small caps were not spared – the Russell 2000 lost 12.22% for the quarter, settling at 1,100.69 on September 30.1

Sources: wsj.com, bigcharts.com, treasury.gov – 9/30/15 1,26,27

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly.

These returns do not include dividends.

Entering the fourth quarter, stock market investors have a central question: can the year be salvaged? Can the S&P 500 possibly finish 2015 with an annualized gain? A Q4 rate hike by the Federal Reserve now looks much less likely, but even if the Fed avoids making a move, will that ease any anxiety about China’s economy or the health of its stock market? Oil prices could remain low, with a major supply glut persisting at a time of reduced demand. Few investors are excited about this oncoming earnings season. Still, the fall could surprise to the upside. As recently as 2013, the S&P 500 gained 10% in Q4. In 2011, it advanced 11% in the last three months of the year. The bulls may be milling around right now, but there is a chance they could run again before 2015 is over – though it will take some notable earnings surprises and encouraging headlines to truly set them loose.28