Quarterly Economic Update

A review of 3Q 2016

The Quarter in Brief

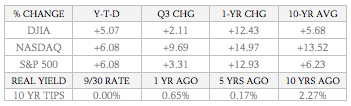

The economy seemed to hit a soft patch this summer, but stocks carried onward and upward – the S&P 500 advanced for a fourth straight quarter in Q3, rising 3.31%. Markets were notably placid for much of the quarter, even with two major banking scandals, multiple terror attacks, and the latest dispatches from an especially contentious presidential race in the headlines. As Q3 went on, the Federal Reserve all but signaled to investors to expect a rate hike before the end of the year. Home sales, residential construction, factory activity, and consumer spending seemed to wane in the quarter, but consumers grew more confident.1

Domestic Economic Health

As Wall Street mulled over the chances of a fall interest rate increase, some economic indicators pointed to a summer slowdown. In August, the Institute for Supply Management’s manufacturing purchasing managers index went under 50 (49.4), meaning the sector had contracted for the month. Both industrial and manufacturing production declined 0.4%. Durable goods orders, up 3.6% for July, were suddenly flat. Retail sales fell off by 0.3%, and personal spending was flat after an 0.4% gain in July (personal incomes did manage to rise another 0.2%).2,3

The pace of hiring also moderated in August, though July’s number was revised upward in September. Employers added 275,000 new jobs in July, 151,000 for August. The headline jobless rate (4.9%), the U-6 rate counting the underemployed and the unemployed (9.7%), and the labor force participation rate (62.8%) were exactly the same in both months.4

Other indicators were less dismal. As September ended, the federal government said the economy grew at a 1.4% pace in Q2 – not very good, but better than the 1.1% growth previously estimated. Additionally, ISM’s service sector PMI remained above 50 in August at 51.4 (though that number was decidedly lower than the 55.5 mark from July).3,5

Accentuating the positive, consumers grew more upbeat as the quarter went on. In July, the Conference Board announced a reading of 97.3 for its consumer confidence index; in August, the CB said the gauge was at 101.1, and in September it reached 104.1. Across the quarter, the University of Michigan’s monthly measure of household sentiment rose slightly from 90.0 in July to 91.2 for September (including a dip to 89.8 for August).6,7

Consumer inflation picked up, but wholesale inflation did not. By August, the Consumer Price Index had advanced 1.1% in a year, as opposed to 0.8% in the 12 months ending in July. Core consumer prices were up 2.3% year-over-year by August. In annualized terms, the Producer Price Index showed no change from a year earlier in August; in monthly terms, the PPI fell 0.4% in July and was flat a month later. Core inflation, as measured by the Federal Reserve, increased 0.1% in July, 0.2% in August.2,3

Speaking of the Federal Reserve, it left interest rates alone during Q3. It did, however, clue Wall Street in on the probability of a Q4 rate hike: its latest dot-plot forecast showed consensus for one, and the vote against raising the federal funds rate at its September policy meeting was close (7-3). After the vote was announced, Fed chair Janet Yellen remarked that FOMC members were “generally pleased with how the U.S. economy is doing” – a notably sunny viewpoint. On September 29, she made further headlines by commenting how useful it would be if the Fed could buy securities and corporate bonds to stimulate the economy in a recession (something it is currently prohibited from doing).8,9

Wells Fargo certainly made headlines in Q3. In September, its CEO was brought before Congress after news broke that employees had opened as many as 2 million fake accounts in pursuit of sales goals. The bank was contending with $190 million in fines and severe damage to its reputation when the quarter ended.10

Global Economic Health

Trouble at another, even larger banking giant emerged during Q3. Deutsche Bank looked increasingly shaky after failing the U.S. government’s bank stress test early this summer and barely passing the equivalent test in the European Union. S&P Global Ratings lowered its outlook for DB to negative. By the end of the quarter, CNBC and AFP were reporting that DB was trying to negotiate $14 billion in fines it owed to the Department of Justice down to the $5 billion level; indications were that the German government had no intention to bail the bank out should its situation worsen.1,11

Economic indicators pointed at a less stagnant E.U. economy during the summer after the Brexit. Eurostat projected 0.4% consumer inflation in September, rising from 0.2% in August; the euro area jobless rate stayed at 10.1% in both July and August, the lowest level observed since July 2011.12

In September, OPEC nations agreed to reduce oil production for the first time since 2008. The agreement, to be finalized in fall, would essentially restore the production limits that were in place back in 2015. Previously, Saudi Arabia had held out on such an agreement, saying it would cut production only if all other OPEC and non-OPEC oil-producing nations vowed to do so.13

World Markets

Benchmarks generally climbed higher in the third quarter, affirming that 2016 has turned into a good year for stocks. By the end of Q3, the U.K.’s FTSE 100 was up 13.82% year-over-year, and Germany’s DAX had seen an 8.80% 12-month advance. Other impressive year-over-year gains: 20.39% for Russia’s Micex, 11.76% for the Hang Seng in Hong Kong, 28.81% for Brazil’s Bovespa, 14.07% for the MSCI Emerging Markets index, and 10.66% for the TSX Composite in Canada. The MSCI World index had risen 9.09% in 12 months; India’s Sensex, 6.54%.14,15

The past four quarters had not been so kind to some other indices. As the third quarter ended, Italy’s FTSE All-Share had lost 21.06% in a year; Spain’s IBEX 35, 8.16%; France’s CAC-40, just 0.16%; China’s Shanghai Composite, 1.55%; and Japan’s Nikkei 225, 5.40%.14

Commodities Markets

Precious metals remained on track to log an impressive 2016 comeback. Gold lost just 0.3% in the quarter, which still left it up 24.2% YTD. The yellow metal closed the quarter at $1,317.10 on the COMEX. Silver wrapped up September at $19.21, rising 3.2% in the quarter and gaining 39.2% through three-fourths of 2016. Platinum advanced 1.0% in Q3; palladium, 20.8%. That brought their respective YTD gains to 15.8% and 28.4%.16

Looking at the Bloomberg Commodity Index, the best Q3 performers were two base metals – zinc rose 12.6% in the quarter; nickel, 11.5%. Sugar advanced 9.8%; cotton, 5.3%; and soybean oil, 4.6%. The worst performers? Lean hogs lost 31.6%; soy meal, 25.1%; soybeans, 17.1%; and wheat, 14.0%. The U.S. Dollar Index retreated but 0.57% for the quarter, finishing Q3 at 95.42.17,18

Like gold, WTI crude was nearly flat for the quarter. Futures lost just 0.2% in Q3, finishing September at a NYMEX price of $48.24. Heating oil rose 2.9% in Q3, while unleaded gasoline retreated 0.9%.1,19

Real Estate

Home sales and housing starts tapered off during the quarter. Existing home sales slipped 3.4% in July and another 0.9% in August as inventory slimmed; the National Association of Realtors also said pending home sales were up 1.2% in July, but down 2.4% a month later. In July, the Census Bureau announced that new home sales were up a whopping 13.8% and near an all-time peak, but then they fell 7.6% in August. Housing starts were up 1.4% for July; building permits, down 0.8%. In August, permits were down another 0.4%, with groundbreaking reduced by 5.8%. The year-over-year advance in the monthly editions of the 20-city Case-Shiller home price index kept shrinking – it was 5.1% in June, 5.0% in July.2,3

Home loans, broadly speaking, grew slightly less expensive across Q3. The September 29 Freddie Mac Primary Mortgage Market Survey specified the following average interest on the three common mortgage types: 30-year FRM, 3.42%; 15-year FRM, 2.72%; 5/1-year ARM, 2.81%. Compare those numbers with these from the June 30 PMMS: 30-year FRM, 3.48%; 15-year FRM, 2.78%; 5/1-year ARM, 2.70%.20

Looking Back…Looking Forward

Tech shares and small caps set the pace in the third quarter – the Nasdaq Composite leapt 9.69%, while the Russell 2000 posted a 3-month gain of 8.20%.1,21

The Dow ended the quarter at 18,308.15; the NASDAQ, at 5,312.00; the S&P 500, at 2,168.27; and the RUT, at 1,251.64. The RUT’s YTD mark at the end of Q3 (+10.19%) surpassed the YTD performances of the big three.22

Concluding the quarter at 13.29, the CBOE VIX retreated swiftly this summer. Its Q3 loss was 10.02%, leaving the “fear index” down 27.02% YTD.23

Sources: wsj.com, cnbc.com, bigcharts.com, treasury.gov – 9/30/16 1,22,24,25

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly.

These returns do not include dividends.

This is the time of year when bulls yearn for an extended rally. Will they get it? Will S&P 500 earnings surpass (low) expectations? Will the market confidently ride through the election, whatever the outcome? Will it simply and calmly price in a rate hike, assuming that happens? Will investors shrug off any unsettling headlines, whether from home or from overseas? If the market can answer “yes” to those last four questions, the quarter could see impressive gains for the major indices. According to S&P Global Market Intelligence research, the S&P 500 has risen an average of 5% in the fourth quarter since 1990, and advanced in the fourth quarter more than 70% of the time since 1945. The past has little or no influence upon future market behaviors, but even with continued slow economic growth, the overall market mood is still bullish – so perhaps investors will look at earnings first this quarter, then other factors. It is sure to be an eventful and possibly turbulent three months.26

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. MarketingPro, Inc. is not affiliated with any broker or brokerage firm that may be providing this information to you. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The FTSE 100 Index is a share index of the 100 most highly capitalized companies listed on the London Stock Exchange. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The MICEX Index is a cap-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. The Hang Seng Index is a freefloat-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. BSE Sensex or Bombay Stock Exchange Sensitivity Index is a value-weighted index composed of 30 stocks that started January 1, 1986. The FTSE Italia All-Share Index is a free float capitalization weighted index that comprises all of the constituents in the FTSE MIB, FTSE Italia Mid Cap and FTSE Italia Small Cap indices. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The SSE Composite Index is an index of all stocks (A and B shares) that are traded at the Shanghai Stock Exchange. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2016/09/30/us-markets.html [9/30/16] 2 – investing.com/economic-calendar/ [9/30/16] 3 – marketwatch.com/economy-politics/calendars/economic [9/30/16] 4 – foxbusiness.com/markets/2016/09/02/tepid-august-jobs-report-lack-wage-growth-muddies-rate-hike-picture.html [9/2/16] 5 – tinyurl.com/zho9nnp [9/6/16] 6 – investing.com/economic-calendar/cb-consumer-confidence-48 [10/3/16] 7 – tradingeconomics.com/united-states/consumer-confidence [10/3/16] 8 – latimes.com/business/la-fi-federal-reserve-meeting-20160921-snap-story.html [9/21/16] 9 – reuters.com/article/us-usa-fed-yellen-purchases-idUSKCN11Z2WI [9/29/16] 10 – reuters.com/article/us-wells-fargo-accounts-idUSKCN11X2NW [9/28/16] 11 – cnbc.com/2016/09/28/deutsche-bank-crisis-explained.html [9/28/16] 12 – ec.europa.eu/eurostat# [10/4/16] 13 – reuters.com/article/us-opec-meeting-idUSKCN11Y18K [9/29/16] 14 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [9/30/16] 15 – msci.com/end-of-day-data-search [9/30/16] 16 – coinnews.net/2016/10/01/gold-silver-mixed-in-3rd-quarter-us-mint-coin-sales-strengthen/ [10/1/16] 17 – bloomberg.com/news/articles/2016-10-02/too-many-fat-pigs-are-making-hogs-the-biggest-commodities-loser [10/2/16] 18 – marketwatch.com/investing/index/dxy/historical [10/3/16] 19 – marketwatch.com/story/oil-prices-continue-to-fall-as-doubts-over-opec-agreement-build-2016-09-30/ [9/30/16] 20 – freddiemac.com/pmms/archive.html?year=2016 [10/3/16] 21 – money.cnn.com/data/markets/russell/ [9/30/16] 22 – markets.wsj.com/us [9/30/16] 23 – money.cnn.com/quote/quote.html?symb=VIX [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F30%2F15&x=0&y=0 [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F30%2F15&x=0&y=0 [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F30%2F15&x=0&y=0 [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F29%2F06&x=0&y=0 [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F29%2F06&x=0&y=0 [9/30/16] 24 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F29%2F06&x=0&y=0 [9/30/16] 25 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [10/3/16] 26 – cbsnews.com/news/time-to-make-some-fourth-quarter-investing-bets/ [9/30/16]