Retirement Tax Webinar

Avoid These 3 Costly Tax Mistakes

(and Preserve More of Your Nest Egg)

Professional Insights So You Can Master Your Retirement

A live, 60-minute online workshop to help you keep more of what you’ve saved and pass on more to the people and causes you care about.

When: Tuesday, January 20 at 6:00 PM

Where: Live Zoom webinar

No cost to attend • 60 minutes including Q&A • A replay link will be provided for all registrants

What You'll Learn: 3 Big Mistakes To Avoid

During this 60-minute session, we’ll walk through common retirement tax mistakes and practical ways to avoid them, including:

Right Assets, Wrong Accounts

How mixing up tax-deferred, taxable, and Roth accounts can cause higher tax bills on the same investments, and how placing the right assets in the right “buckets” can make your money work harder for you.

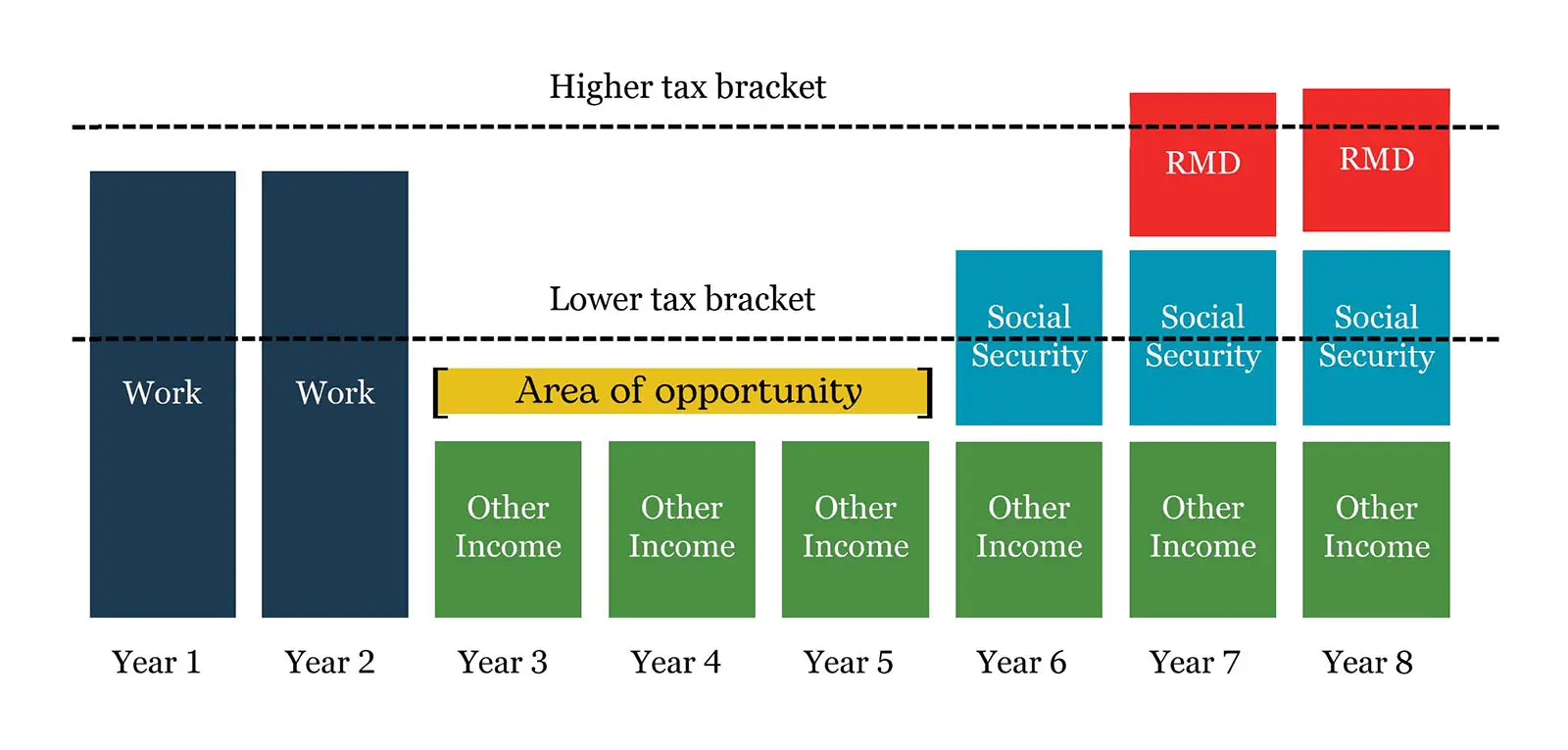

Opportunity Zone Years

Many retirees have a few years with lower income before Social Security and RMDs kick in. We’ll show you how to use this window to take smarter withdrawals, consider Roth conversions, and potentially lock in lower tax rates.

Charitable Giving

If you give regularly to charity, we’ll cover strategies—like gifting appreciated investments or giving directly from certain retirement accounts—that can help you support the causes you care about in more tax-efficient ways.

You’ll also learn three simple, practical strategies to take more control over how you’re taxed in retirement. These approaches can help you determine when to draw from different accounts, how to capitalize on lower-tax years, and ways to structure your giving or legacy planning more effectively. The goal is to provide you with easy steps that you can start applying right away, so more of your money stays working toward your long-term goals.

Is This Webinar Right For You?

Retirement planning is about more than numbers. It is about feeling confident that the choices you make today will support the life you want for many years. If you are unsure how taxes might affect your income, your investments, or the people you care about, this session will bring clarity and provide guidance you can feel good about. We will walk through real situations that many retirees face and share simple ways to make thoughtful, intentional decisions with your savings.

This session is designed for you if:

- You are within 5 to 10 years of retirement or recently retired and want a better understanding of how taxes change once you stop working.

- You have savings in 401(k)s, IRAs, brokerage accounts, or Roth IRAs, and want to be intentional about how and when you use them.

- You hope to support family or charities and want to understand how taxes influence the impact of your generosity.

- You want clear and practical guidance that helps you talk comfortably with your tax and financial professionals.

Many people feel uncertain about retirement tax planning, and it is completely normal to have questions. You do not need to be a tax expert. This webinar keeps everything in simple, everyday language and focuses on strategies you can begin discussing right away.

Hosted by Personal Wealth Advisory

Andrew Barninger is a partner and certified financial planner with Personal Wealth Advisory, LLC (PWA), where he helps individuals and families create tax-aware retirement strategies tailored to their unique goals. His background in finance and commitment to practical, easy-to-understand guidance make him a trusted guide for retirees navigating complex tax and retirement decisions.

Personal Wealth Advisory works with individuals and families who want thoughtful, tax-aware retirement planning. Our team helps clients coordinate investments, withdrawal strategies, and charitable giving so their money supports the life they want today — and the legacy they hope to leave tomorrow.

Ready to Take Control of Your Retirement Taxes?

You’ve worked hard to build your retirement savings. Now it’s time to be intentional about how you’re taxed so you can enjoy your lifestyle and pass more on to the people and causes that matter most.

Reserve your spot for our January 20th webinar and take control of your retirement taxes.

This information is provided for general purposes and is subject to change without notice. This information is not tax or legal advice. The information does not represent, warrant or imply that services, strategies or methods of analysis offered can or will predict future results, identify market tops or bottoms or insulate investors from losses. All types of investing and investment strategies involve risk including the potential loss of principal. Asset allocation & diversification do not ensure a profit or prevent a loss in a declining market. Past performance is not a guarantee of future results. Before acting on this information, consult your Financial Advisor for individual financial advice based on your personal circumstances.

Securities offered through Geneos Wealth Management, Inc. / Member FINRA/SIPC. Advisory Services offered through Personal Wealth Advisory, LLC and Geneos Wealth Management, Inc a Registered Investment Advisor.

Sound good so far? Let’s talk.

Book your free Introductory Session where we’ll talk about what’s on your mind and how we can help.